We may earn money or products from the companies mentioned in this post at no additional cost to you.

The Impact of Inflation on People With Savings

Inflation affects all aspects of our lives, but it is especially hard for those who have saved up money. In this article, we will explore why people with savings are particularly hurt by inflation and what can be done to protect against its effects. We’ll look at the impact that rising prices have on people’s purchasing power and how financial institutions can help soften the blow. By understanding these concepts more fully, individuals with savings can make better decisions about their finances in order to safeguard their wealth from erosion due to inflation.

The concept of inflation is grounded in economics; it refers to the sustained increase in prices over time. This means that goods cost more now than they did yesterday and even more tomorrow than today. Prices rise as wages go up, which usually happens slower than the rate of inflation, meaning that your spending power decreases because you’re unable to buy as much with a given amount of money compared to before prices rose. This problem is compounded when considering investments such as bonds or certificates of deposit (CDs). These assets generate income based on fixed interest rates that do not keep pace with increasing costs – leaving investors worse off after accounting for inflationary losses.

Finally, there are strategies that savers can implement in order to minimize the damage caused by inflation. For example, investing in assets like stocks or mutual funds allows one’s portfolio to benefit from capital gains instead of relying solely on cash accounts earning low yields – though there is always an element of risk involved here too! Additionally, diversifying investments into a mix of different asset classes helps spread out risk further and provides some protection against unexpected shocks caused by changes in market conditions. With a bit of knowledge and planning, people with savings can ensure their wealth remains secure despite increases in price levels across various sectors.

What is Inflation?

Inflation is an economic term used to refer to the general increase in prices of goods and services over time. It is usually measured as an annual percentage rate of change in prices. Inflation is caused by an increase in the money supply, an increase in government spending, or a decrease in taxes. When inflation increases, the purchasing power of money decreases, leading to higher cost of living.

Inflation is a sustained rise in the prices of goods and services over time. It is measured by an index such as the Consumer Price Index (CPI) or Producer Price Index (PPI). Inflation is caused by many factors, including changes in supply and demand, government policy, and currency devaluation.

When inflation rises, it decreases the purchasing power of money. This means that people with savings find their wealth eroding since they cannot buy as much with those same dollars due to rising prices. The opposite effect occurs when deflation takes place; consumers can purchase more with the same amount of money than before.

The impact of inflation on individuals depends upon whether they have additional income sources, such as investments or wages from employment, or rely solely on fixed incomes like pensions or Social Security benefits. Those who are retired or living off of fixed incomes often struggle to make ends meet during periods of high inflation because their incomes do not increase at the same rate as prices for basic necessities such as food and housing costs.

Effects Of Inflation On Savings

Inflation is an unavoidable economic phenomenon, and its effects can be felt in nearly all aspects of life. One particular area where inflation affects individuals significantly is savings. People who have saved money as a form of financial security are often hurt by the presence of inflation.

The first way that people with savings are affected by inflation is through the erosion of their purchasing power. As prices rise due to higher levels of inflation, one’s ability to buy goods or services decreases; this has a direct effect on those with limited funds since they will not be able to purchase items at their original cost anymore. This means that if someone wants to maintain their standard of living, they must find new ways to increase their income or reduce expenses.

Another way that high levels of inflation hurt savers is when it comes time for them to withdraw money from their accounts. Inflation may cause the value of the currency to decrease over time, meaning that what was worth $100 today might only be worth $90 tomorrow. This devaluation could lead to losses in real terms unless the investor takes proactive steps, such as diversifying investments into assets like stocks and bonds that offer protection against volatility.

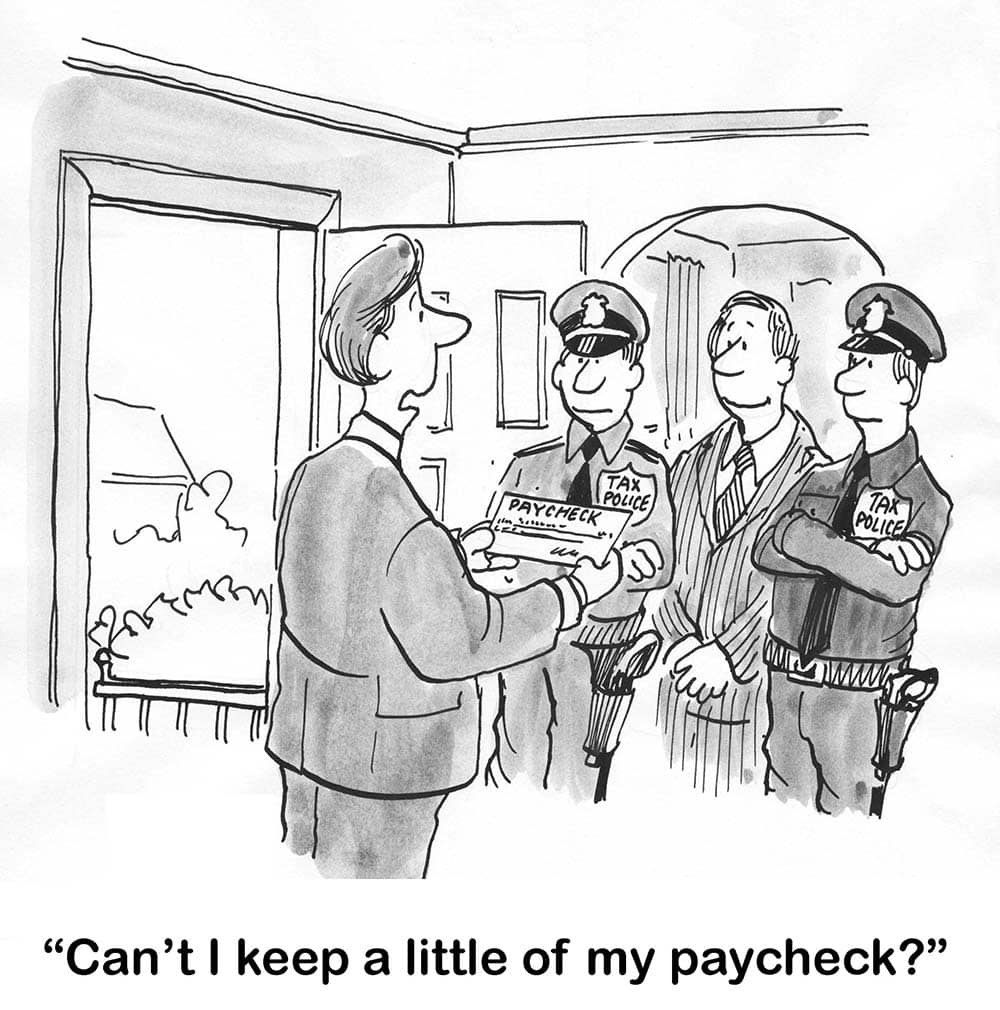

Finally, another issue caused by rising inflation rates is the potential for increased taxes on capital gains and other forms of investment income. This can put additional strain on investors who rely heavily on returns from these sources, leading them to incur larger tax liabilities than previously expected, which could further erode any gains made over time. To avoid these issues, investors should become familiar with current tax laws and plan accordingly so they don’t get caught off guard come tax season.

Cost Of Living Increases

Inflation is a major factor in the rising cost of living. When prices rise due to inflation, individuals with savings are often disproportionately affected. This is because the value of their existing funds increases at a different rate than the prices for goods and services, like fashion and Homegoods. As such, purchasing necessary items with their money over time can be difficult or impossible.

The higher prices associated with increased costs of living also create an uneven playing field between those who have savings and those who do not. Those without any reserves are less impacted by inflation since they must use current income to pay for necessities and cannot rely on past earnings that may now lack purchasing power. On the other hand, people with some form of financial cushioning must increasingly stretch these funds further each year despite having no additional source of revenue coming in.

Ultimately, this discrepancy between savers and non-savers presents a challenge when attempting to maintain fiscal stability in times of economic instability caused by factors like inflation. It is important for individuals—especially those with substantial assets—to actively plan ahead by accounting for price changes and seeking out ways to make their money go further in order to protect themselves from harm during periods of high inflation rates.

Strategies To Protect Against Inflation

Inflation can have a major impact on savers. As the cost of living increases due to inflation, people with savings are likely to see their purchasing power decrease. This is especially true for those whose investments do not keep up with the rate of inflation. To protect against this erosion of purchasing power, it’s important to employ strategies that will help mitigate the effects of rising prices and preserve savings over time.

One way to achieve this is by investing in assets such as stocks or bonds, which can generate returns above the average rate of inflation. Investing in these types of assets also helps diversify one’s portfolio, reducing risk from any single investment type. Additionally, many companies offer insurance products designed specifically to hedge against inflation risks which can be beneficial for investors looking for additional protection from rising costs.

Savings accounts are also an option for savers who want more stability when protecting their money from inflationary pressures. Many banks offer special high-yield accounts which feature higher interest rates than standard savings accounts and provide greater potential rewards over time. These accounts often come with certain restrictions, such as minimum balance requirements, so it’s important to read through all terms before deciding if they’re right for you. With careful planning and smart investing decisions, individuals can ensure their hard-earned savings remain safe despite economic volatility caused by inflationary forces.

Why Are People With Savings Hurt By Inflation?

People with savings are hurt by inflation because their money loses purchasing power. As prices rise due to inflation, the same amount of money buys less. This means that the buying power of a person’s savings is reduced and they may be unable to purchase the same amount of goods and services they could before. Furthermore, if interest rates do not keep up with inflation, the amount of interest earned on savings will not compensate for the loss in purchasing power.

Inflation can have a damaging effect on savings. When prices rise faster than incomes do, it erodes the purchasing power of those with saved money. This means that in order to maintain the same level of spending, individuals must either work more or save less.

It’s important for people to be aware of how inflation impacts their savings and take steps to protect themselves against its effects. There are several strategies they can use, such as diversifying investments across different asset classes or investing in commodities like gold which tend to hold up better during periods of high inflation. In addition, managing debt levels by paying off credit card balances quickly can help keep costs down and reduce financial stress during times when prices increase rapidly.

Overall, being mindful of inflationary trends is essential for anyone looking to build lasting wealth over time. By having an understanding of what causes these price increases and taking proactive steps to mitigate them, individuals can ensure their savings remain secure even if inflation rises unexpectedly.